LTC Needs

When we look into the past at our parents, grandparents, or great grandparents, long-term care didn’t seem to be as big of an issue as it is today.

This could be due to the fact that families were able to take care of their loved ones if they lived long enough to need long-term care.

Families have changed a lot over the years, making it more difficult for them to take on the responsibility of care giving. Two family incomes, divorce, multiple children and geographical separation are to name just a few of those challenges.

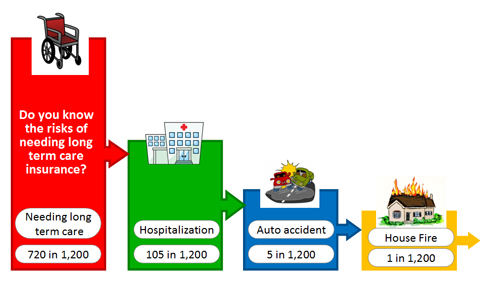

There is a 70% chance individuals over age 65 will need Long Term Care.

AI&PS can help you maintain freedom, independence and dignity in your later years.

Control your choices by protecting yourself with a Long Term Care Insurance Plan.

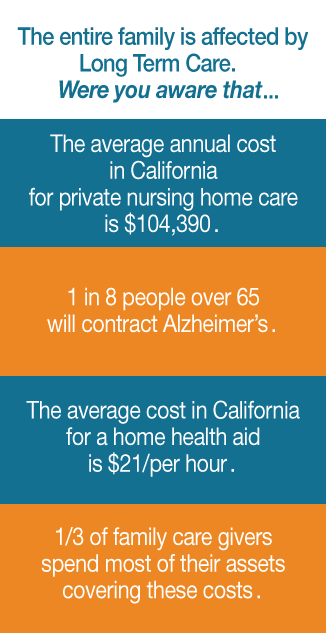

Long Term Care Expenses

Do you know the risk?

An average American couple retiring at age 65 today, would need a present value lump sum of $293,000 to cover future health insurance premiums and out-of-pocket medical expenses over the remainder of their lives, i.e., expenses not paid by Medicare.

(Source: Society of Actuaries)